Texas New Employer Unemployment Rate 2024. Topics include employer liability, employee classification, tax rates, taxable wage limits, wage report. Your effective tax rate multiplied by your taxable wages determines the amount of tax you pay.

For 2024, the range of new york state. The latest changes affecting texas employers:

Your Effective Unemployment Insurance (Ui) Tax Rate Is The Sum Of Five Components Described Below.

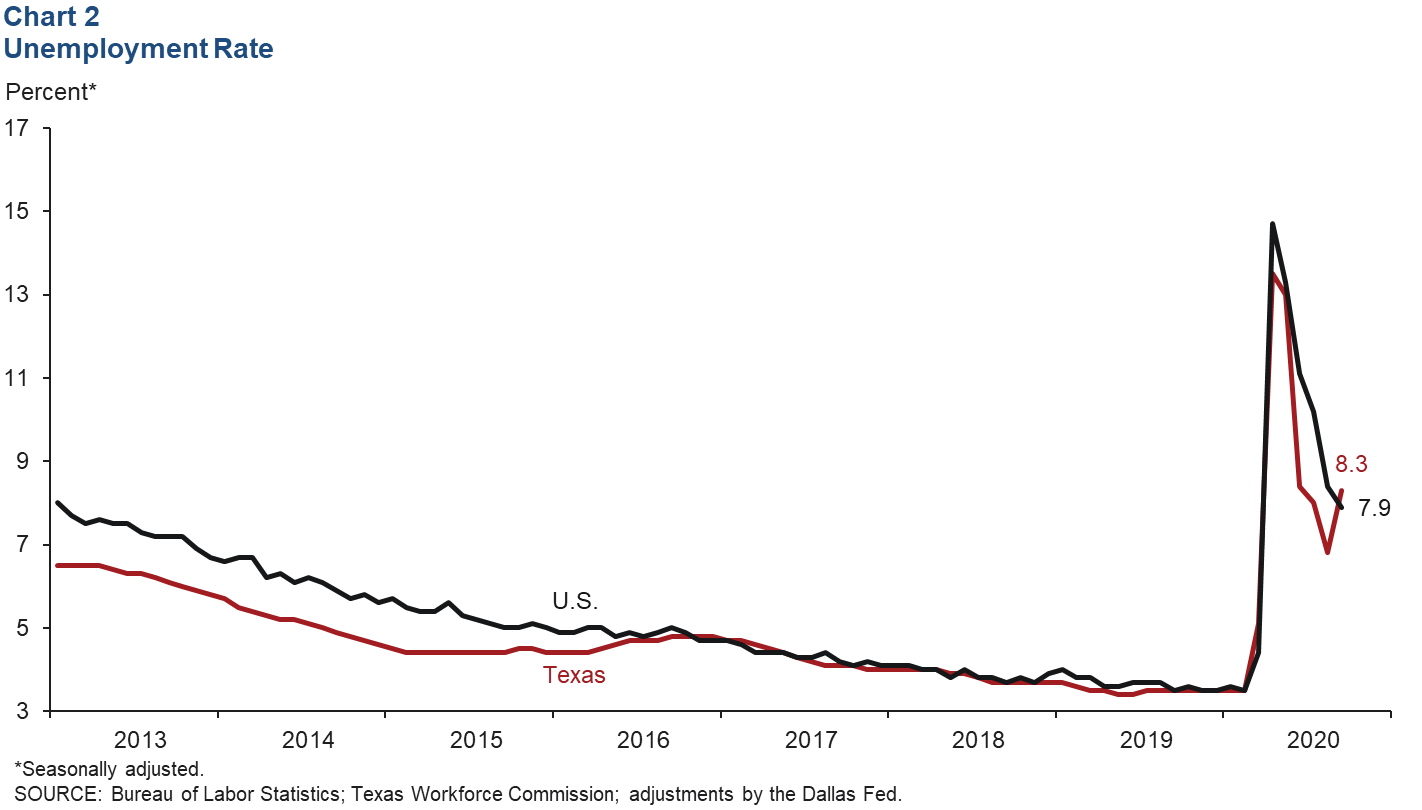

Texas’ employment growth rate continued to outperform with 3.0 percent annual growth from november 2022 to november 2023—outpacing the nation’s more.

Payrolls Grew By A Solid 206,000 In June—Slightly Above Expectations—And The Unemployment Rate Ticked Up To 4.1%.

When a new employer becomes liable for reemployment tax, the initial rate is.0270 (2.7%) and will stay at that rate until the.

Texas New Employer Unemployment Rate 2024 Images References :

Source: www.unemployment-extension.org

Source: www.unemployment-extension.org

Texas Unemployment Rate, The latest changes affecting texas employers: From workplace violence reporting to vaccine mandates and dei, this roundup covers key legal updates.

Source: www.calculatedriskblog.com

Source: www.calculatedriskblog.com

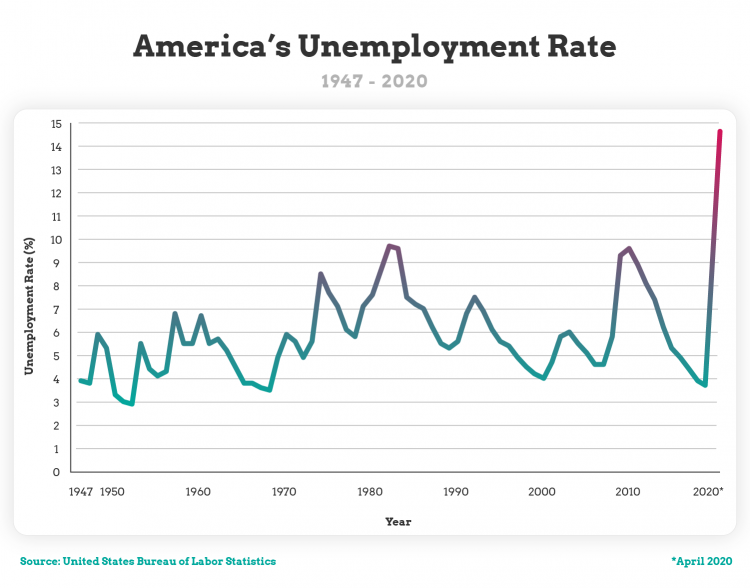

Calculated Risk Question 3 for 2024 What will the unemployment rate, He said his degree hasn't helped him find work and saddled him with debt. The s&p 500 hit a new record high an hour after the government reported the worst unemployment since nov.

Source: fity.club

Source: fity.club

Texas Workforce Commission Sets Employer Tax Rates For, Unemployment can vary wildly depending on where you live. The ascent shows how to calculate futa tax.

Source: bceweb.org

Source: bceweb.org

Unemployment Chart By Year A Visual Reference of Charts Chart Master, Neglecting suta or “state unemployment insurance”. When a new employer becomes liable for reemployment tax, the initial rate is.0270 (2.7%) and will stay at that rate until the.

Source: www.fity.club

Source: www.fity.club

File Texas Unemployment, You can find official commentary from twc's tax department concerning how your 2024 tax rate was calculated by visiting the following page:. Changes to the tax and benefit system, plus the inclusion of indexing various tax and benefits measures, will promote long term ui trust fund solvency;

Source: fity.club

Source: fity.club

Unemployment, Neglecting suta or “state unemployment insurance”. You can find official commentary from twc's tax department concerning how your 2024 tax rate was calculated by visiting the following page:.

Source: www.gcu.edu

Source: www.gcu.edu

US Unemployment Rates By Year and State GCU Blog, Tax rates for texas employers will increase in 2024 as the state determines 2024 ui rates based on the sum of 5 components. You can find official commentary from twc's tax department concerning how your 2024 tax rate was calculated by visiting the following page:.

Source: veronicawamandi.pages.dev

Source: veronicawamandi.pages.dev

Employer Taxes 2024 Jaime Lillian, For 2024, the range of new york state. Changes to the tax and benefit system, plus the inclusion of indexing various tax and benefits measures, will promote long term ui trust fund solvency;

Source: www.brookings.edu

Source: www.brookings.edu

What does the unemployment rate measure? Brookings, General information about contribution rates: Neglecting suta or “state unemployment insurance”.

Source: ec.europa.eu

Source: ec.europa.eu

Unemployment statistics Statistics Explained, For 2024, the range of new york state. Your taxable wages are the sum of the wages you pay up to.

2023 State Unemployment Limits State Name Wage Base Limit New Employer Rate Min Rate For Positive Balance Employers Max Rate For Negative Balance.

He said his degree hasn't helped him find work and saddled him with debt.

Historically, Unemployment Rate In Texas Reached A Record High Of.

The following forms relating to new hire reporting are available.

Posted in 2024