How To Complete W-4 Form 2025. On this page, we will post the latest tax information relating 2025 as it is provided by the irs. Extra withholding, exemptions, and other things workers need to know.

It tells the employer how much to withhold from an employee’s paycheck for taxes. Ensure you stay compliant and review your tax.

Extra Withholding, Exemptions, And Other Things Workers Need To Know.

This tax return calculator will calculate and estimate your 2025 tax return.

Your Withholding Is Subject To Review.

Is a large tax refund a self imposted penalty?.

How To Complete W-4 Form 2025 Images References :

Source: www.youtube.com

Source: www.youtube.com

How to Complete Form W4 Tutorial YouTube, Taking steps to reduce your tax liability can benefit you at tax time, but you may also benefit throughout the year by adjusting your withholding to increase your take. Ensure you stay compliant and review your tax.

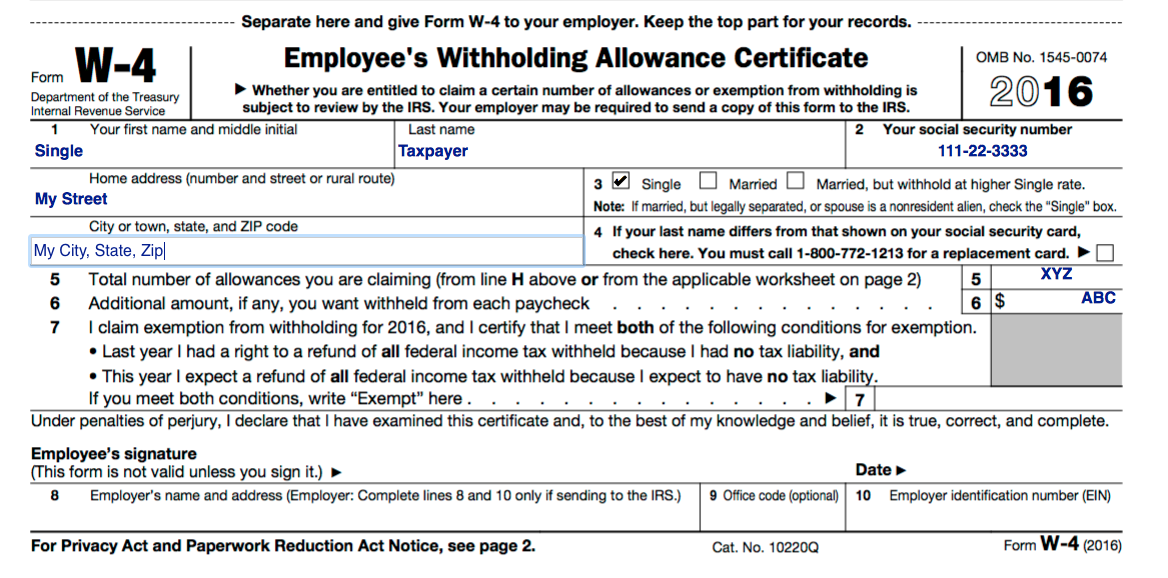

:max_bytes(150000):strip_icc()/2023FormW-4-64302bb2a6504482bab1e847bbc4cb1a.jpg) Source: www.investopedia.com

Source: www.investopedia.com

Form W4 What It Is and How to File, Extra withholding, exemptions, and other things workers need to know. Sign up now to obtain new tax calculator updates.

Source: thegeorgiaway.com

Source: thegeorgiaway.com

How to Complete the W4 Tax Form The Way, Taking steps to reduce your tax liability can benefit you at tax time, but you may also benefit throughout the year by adjusting your withholding to increase your take. Find tax return calculators for.

Source: es.wikihow.com

Source: es.wikihow.com

Cómo llenar un W4 (con imágenes) wikiHow, It tells the employer how much to withhold from an employee’s paycheck for taxes. Your withholding is subject to review.

Source: www.moneyinstructor.com

Source: www.moneyinstructor.com

Money Instructor Personal Finance, Business, Careers, Life Skills Lessons, Answer each question by either clicking on the options shown or by entering. We will update this page for tax year 2025 as the forms, schedules, and instructions become available.

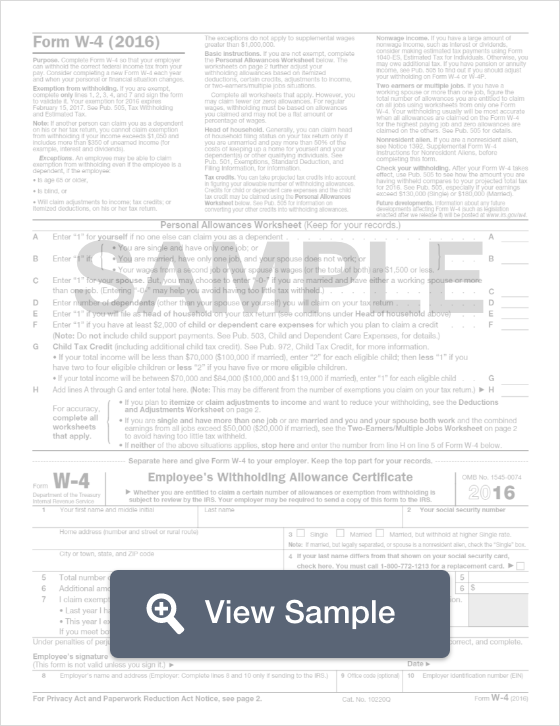

Source: pdf.wondershare.com

Source: pdf.wondershare.com

IRS Form W4 Follow the Instructions to Fill it without Errors, Extra withholding, exemptions, and other things workers need to know. Taking steps to reduce your tax liability can benefit you at tax time, but you may also benefit throughout the year by adjusting your withholding to increase your take.

Source: www.rletaxes.com

Source: www.rletaxes.com

W4 RLE Taxes, Ensure you stay compliant and review your tax. This tax return calculator will calculate and estimate your 2025 tax return.

Source: formswift.com

Source: formswift.com

W4 Form Create & Download FormSwift, We will update this page for tax year 2025 as the forms, schedules, and instructions become available. Is a large tax refund a self imposted penalty?.

Source: onpay.com

Source: onpay.com

Meet the New W4 Form! What Employers Need to Know OnPay, Answer each question by either clicking on the options shown or by entering. Taking steps to reduce your tax liability can benefit you at tax time, but you may also benefit throughout the year by adjusting your withholding to increase your take.

Source: komonews.com

Source: komonews.com

The new IRS Form W4 has many scratching their heads Here's what you, Sign up now to obtain new tax calculator updates. Ensure you stay compliant and review your tax.

It Tells The Employer How Much To Withhold From An Employee’s Paycheck For Taxes.

Find tax return calculators for.

Taking Steps To Reduce Your Tax Liability Can Benefit You At Tax Time, But You May Also Benefit Throughout The Year By Adjusting Your Withholding To Increase Your Take.

Answer each question by either clicking on the options shown or by entering.

Category: 2025